On election night in 2016, attorney Keith Davidson, who represented Stormy Daniels at the time, texted then-National Enquirer editor Dylan Howard with a revealing question: “What have we done?” This message came as it became increasingly apparent that Trump would win the election. The Enquirer had also engaged in a “catch and kill” initiative to bury potentially damaging stories about Trump.

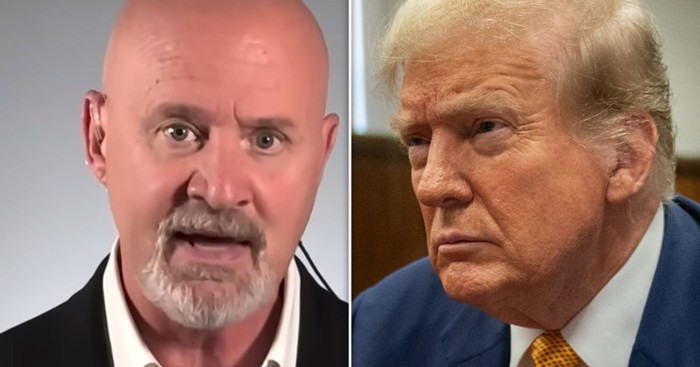

Kirschner described this testimony as “breathtaking” and emphasized that it directly undermines one of Trump’s key defense assertions. Davidson’s acknowledgment of his actions potentially impacting the election result suggests that they recognized the damage caused by their conduct. Moreover, it’s clear that the hush money payments were intended to influence the election, not merely to conceal information from Melania or Trump’s family.

This revelation could have far-reaching consequences for Trump’s criminal responsibility. It challenges the defense’s attempts to distance Trump from any wrongdoing. As the trial unfolds, the impact of this admission remains to be seen.

Comments

Post a Comment